For the love of money is a root of all kinds of evil. Some people, eager for money, have wandered from the faith and pierced themselves with many griefs. (1 Timothy 6:10).

But money spent while manic doesn’t fit into the Internal Revenue Service concept of medical expense or business loss. So after mania, when most depressed, you’re given excellent reason to be even more so. ~ Kay Redfield Jamison, An Unquiet Mind: A Memoir of Moods and Madness.

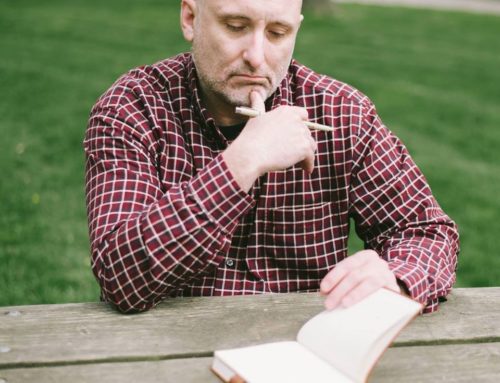

A few years ago I walked into a car dealership intent on driving one home. I had done no research. In fact, I had only concocted the scheme that morning. My thinking was I needed an all-wheel drive with plenty of seats for my children and grandchildren. I didn’t consider that I only saw them every other month or that the prospect of me taking them for a drive was next to none. I had a notion that set in motion a purchase that would burden me with debt for years.

It could have been worse, though…

… like a woman who quit her job one Friday, emptied her bank account, bought a motorcycle, and headed West. By Monday, she was broke, hung over, and somewhere in the middle of Montana.

… or, the man who had accumulated a vast sum playing the Market. One night at a bar he met a fellow who convinced him to trade it in for a campground. Sight unseen.

… or even Kay Jamison (see quote above). A leading researcher on the causes and effects of bipolar, if anyone should know better how to avoid extravagant spending on a manic binge, it is her. Yet she details a weekend jag to Paris where she spent thousands she didn’t have on designer shoes.

No, I have been spared this penchant for profligate spending. Money does not burn a hole in my pocket. My love for money takes a much different form. Frugality. Or, as my family puts it — being cheap.

Now there is nothing wrong about being a good steward of the resources God gives us. John Wesley is known to have advised believers, “Earn all you can. Give all you can. Save all you can.” The mantra for modern Americans, including Christians, is “Spend all you want. Go in debt as much as you have to. Work yourself to an early grave trying to pay it off.” This mantra has robbed many people of the capacity to give themselves for the work of the Lord. It has also stripped them of their health — not only fiscal, but physical, psychological, relational, and spiritual.

Debt can be a parasite that leeches off the life-blood of faith.

This reality has fostered an almost unreal fear in me about living within my means. I am most decidedly frugal. Thrifty. Or, as those who know me best say, CHEAP!!!

This compunction started early…

… When I was in college, to save money on paper, I wrote on the backs of old flyers.

… In grad school, I would do laps around grocery stores for free samples.

… My wedding suit was a $5 special from Burlington Coat Factory.

And it persisted…

… Instead of getting WiFi, I rode my bike to a cafe with bottomless cups of coffee.

… I bought an air mattress and slept at rest stops rather than pay for a hotel.

… I went 4 months with a daily food budget of less than $5. It was healthy too. Oatmeal. Beans. Quinoa. Eggs. Salad. I even calculated I could make gourmet coffee at home for just 18 cents per travel mug.

I spend a lot of time thinking about money. Too much, I suspect. My love of money is not found so much in earning or spending, but in saving. Yet, this love can still be the root of all kinds of evil. Like when…

… We are consumed by what we lack that we to appreciate God’s abundant provisions.

… We become possessive with money in marriage, threatening this sacred covenant.

… We place things accumulated over experiences shared.

Of course, some spending is necessary — to pay present bills. And saving is prudent — to pay future ones. The key is to balance our account with a faith perspective that loving God, others, and self, is so much better than loving money. They are not even in the same ballpark.

By the way, have you seen how much it is to go to the ballpark these days?